The Digital Transformation of Thai Consumers

The digital age has ushered in a new era for Thai consumers, characterized by the seamless integration of online and offline experiences. This online-offline convergence, often termed as “O2O” (Online to Offline), signifies a lifestyle where digital platforms complement and enhance real-world experiences rather than replace them. Whether it’s shopping, entertainment, or education, the boundaries between the virtual and physical worlds are becoming increasingly blurred.

Furthermore, the power of search data cannot be understated. With millions of searches conducted daily, this data serves as a goldmine of insights, offering a real-time window into the minds of consumers.

For businesses, this means an unparalleled opportunity to predict market trends, understand consumer intent, and craft strategies that resonate with the evolving demands of the Thai populace.

Understanding Thai Consumer Behavior

Search data, often termed as the “digital footprint” of consumers, offers invaluable insights into their preferences, habits, and decision-making processes. In Thailand, as digital adoption has surged, so has the richness of this data, painting a vivid picture of the evolving Thai consumer.

- Volume and Trends:

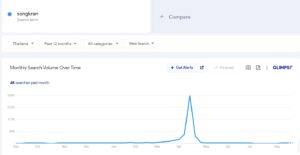

The sheer volume of searches conducted daily is staggering. For instance, if there were hypothetically 10 million searches related to e-commerce in Thailand in 2019, this number might have surged to 15 million by 2021, indicating a growing interest in online shopping. Such trends can be pivotal for businesses to understand market demand. - Seasonal Fluctuations:

Search data can reveal seasonal trends. For example, searches related to “Songkran festival shopping” might see a spike in April, the month the festival is celebrated. Similarly, “winter clothing” might see an uptick during the cooler months.

- Local vs. Global:

The balance between local and global searches can offer insights into consumer preferences. A surge in “local Thai restaurants” over “international cuisines” might indicate a growing preference for local flavors. - Emerging Categories:

Search data can spotlight emerging categories. If there’s a sudden spike in searches for “sustainable fashion brands in Thailand,” it’s a clear indication of the growing eco-consciousness among Thai consumers. - Consumer Concerns and Queries:

The “People Also Ask” section in search engines can provide insights into common consumer queries or concerns. For instance, if many are asking, “Is online banking safe in Thailand?”, it indicates a potential trust issue that banks need to address. - Demographic Insights:

Certain platforms offer demographic breakdowns of search data. Knowing that a majority of searches for “luxury watches” come from males aged 25-34 in Bangkok can be invaluable for targeted marketing.

- Predictive Analysis:

By analyzing patterns and trends in search data, businesses can predict future demand. If searches for “electric cars in Thailand” have been steadily increasing over the past two years, it’s a strong indicator of future market potential. - Competitive Analysis:

Search data can also reveal how often a brand or product is searched in comparison to its competitors, offering insights into market share and brand popularity. - Shifts in Behavior:

Post-pandemic, there might be a noticeable shift in searches from “international travel” to “local Thai getaways,” indicating a change in travel preferences due to global restrictions. - Adapting to Real-time Changes:

Search data is real-time. A sudden spike in searches for “face masks in Thailand” might indicate a health concern or an outbreak, allowing businesses to adapt swiftly.

Overall, search data is not just numbers; it’s a narrative. For businesses in Thailand, it’s a narrative of opportunity, offering a roadmap to align with the evolving needs and preferences of Thai consumers.

Major Industries and Their Trends

Retail

The transformation of Thailand’s retail landscape, particularly in the aftermath of the pandemic, mirrors a distinct shift in the search behavior of Thai consumers towards online shopping. This is evident in the burgeoning internet economy of Southeast Asia, where e-commerce dominates, and revenue is expected to show an annual growth rate (CAGR 2023-2027) of 11.43%.

As Thai consumers increasingly embrace localized experiences, there’s a notable uptick in localized search queries, such as “near me” or specific local online stores.

- Optimizing Google My Business (GMB) Listings: A well-optimized GMB listing is the cornerstone of local SEO. Businesses should ensure that their listings are complete, accurate, and updated regularly. This includes adding high-quality images, business hours, and a detailed description. Regularly posting updates or offers on GMB can also increase visibility and engagement.

- Gathering Reviews: Reviews play a pivotal role in influencing consumer decisions. Encouraging satisfied customers to leave positive reviews can boost a business’s credibility. It’s also essential to respond to these reviews, both positive and negative, as it showcases a brand’s commitment to customer satisfaction.

- Consistent NAP Across Platforms: Ensuring that a business’s Name, Address, and Phone Number (NAP) are consistent across all online platforms is crucial. Inconsistencies can confuse search engines and reduce the chances of ranking high in local search results.

Lazada Case Study

Lazada, a dominant e-commerce player in Southeast Asia, effectively bolstered its presence in the Thai market by employing a multifaceted digital strategy. They optimized for local searches specific to Thai consumers, utilized AI for tailored product recommendations, and integrated chatbots for instant customer support. This approach led to a marked increase in their Thai user base, heightened engagement, and a surge in sales.

Virtual try-ons

Furthermore, the advent of virtual try-ons, previously deemed futuristic, signifies consumers’ growing tech-savviness. This trend is reflected in search patterns, with more users seeking information on virtual shopping platforms and their reviews. In essence, the blend of digital and physical shopping realms in Thailand is reshaping how consumers use search engines, intertwining online browsing with in-store purchasing decisions.

Finance

The burgeoning popularity of digital financial services and cryptocurrencies has led to a spike in related online queries. Financial institutions, recognizing this shift, have a golden opportunity to refine their digital marketing strategies.

By optimizing their content around trending search terms such as “best digital banking Thailand” or “cryptocurrency trading platforms in Thailand”, they can effectively capture the attention of the digitally-savvy Thai consumer. Furthermore, the intricate nature of the digital finance world has created a thirst for knowledge. Institutions can quench this by offering comprehensive content on subjects like digital assets and risk management, thereby establishing themselves as industry pioneers. To further elevate their online presence, integrating user-friendly tools like investment calculators or cryptocurrency converters can significantly boost user engagement and organic site visits.

Consumer Insights

Value for Convenience

Thailand’s rapid digitalization is a reflection of the evolving consumer mindset. At the heart of this transformation is the consumer’s value for convenience. This is evident in the growing demand for services that provide instant access. Interestingly, the rise of “near me” searches underscores this trend, indicating a preference for local businesses and services, emphasizing the significance of local SEO for businesses.

Implications for Brands

In the rapidly changing Thai digital landscape, understanding consumer search behavior is paramount for brands aiming for success. The digital age has ushered in an era where consumers expect real-time responses, pushing brands to be more agile and adaptive. Leveraging automated marketing solutions, powered by AI and machine learning, brands can now tailor their messaging and optimize campaigns instantly. As technology continues to mold consumer behavior, brands integrating app and omnichannel strategies will be at an advantage, ready to meet the ever-evolving needs of the Thai consumer.

Conclusion

In the dynamic Thai market, grasping and adapting to consumer behavior trends is more than just a business strategy; it’s the cornerstone of enduring success. With technology persistently altering consumer preferences and the engagement playbook, businesses that stay proactive and in sync with these changes will ensure their relevance. By doing so, they’ll be perfectly poised to address the intricate desires of the Thai consumer, ensuring a competitive edge in the market.